Business

Metro Pacific Investments Reports 14% Increase in Core Net Income Driven by Power and Water Units

Juancho Mabini

24 Jan, 2026

Metro Pacific Investments Corp. (MPIC) recorded robust growth in the first nine months ending September, with its power and water operations spearheading the uptrend. The conglomerate reported a 14 percent increase in core net income to ₱23.6 billion from ₱20.8 billion during the same period last year.

The company attributed this improvement to the strong performance of Manila Electric Co. (Meralco) in power generation, the implementation of higher tariffs by Maynilad Water Services, and increased patient volumes across its hospital network, which collectively boosted operational contributions by 12 percent to ₱27.2 billion.

Power remains MPIC’s largest revenue generator, accounting for ₱17.6 billion or 65 percent of net operating income. Meanwhile, water and toll roads contributed ₱5.8 billion and ₱4.4 billion respectively, comprising 37 percent of net operating income combined.

Despite the growth in core earnings, reported net income rose more modestly by seven percent due to a one-time gain in the prior year from a subsidiary, which affected the year-on-year comparison despite solid underlying business performance.

MPIC Chairman, President, and CEO Manuel V. Pangilinan highlighted the resilience of the company’s core operations. He remarked, "Power and water continued to deliver strong results, while our tollroads faced short-term pressures from higher financing costs but are expected to rebound as newly developed roads mature."

Pangilinan also pointed to the public listing of Maynilad as a strategic move to unlock further value and enable reinvestment in enhancing water supply infrastructure and accessibility. "We remain focused on creating sustainable, long-term value across portfolio sectors critical to national development, including energy, water, and food security," he stated.

Meralco’s consolidated core net income surged 14 percent to ₱40 billion, bolstered by gains in both power generation and distribution segments. Maynilad posted an 18 percent jump in core net income to ₱11.4 billion, driven by increased revenues and moderated expense growth.

Contrastingly, MPIC’s toll road unit, Metro Pacific Tollways Corp., experienced a slight 2 percent decline in core net income to ₱4.8 billion. This was due to elevated financing expenses linked to the acquisition of the Jasa Marga Tollroad and cessation of interest capitalization as new toll facilities commenced operation. Nevertheless, toll revenue grew markedly by 17 percent to ₱27 billion, supported by rate hikes and higher traffic volumes within the Philippines.

Recommended For You

Former DPWH Official Becomes State Witness in Flood Control Project Probe

Jan 24, 2026

Juancho Mabini

Emirates Urges Boeing to Develop Larger 777X Jet Amid Delivery Delays

Jan 24, 2026

Juancho Mabini

Twelve Communist Rebels Surrender in Maguindanao del Sur, Signaling Decline in Insurgency

Jan 24, 2026

Teofilo Abad

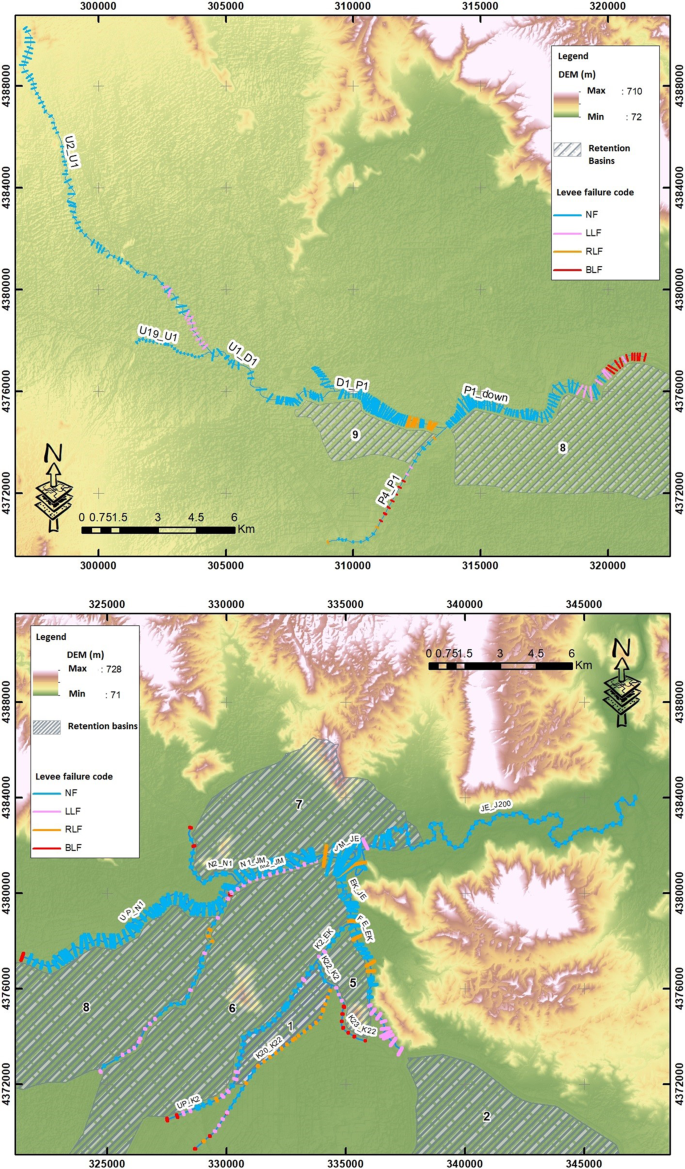

DEPDev to Develop River Basin Master Plan by Next Year to Enhance Flood Control

Jan 24, 2026

Ligaya Almeda