Economy

SEC Proposes Expanded Asset Eligibility for REITs to Enhance Capital Market Activity

Juancho Mabini

10 Feb, 2026

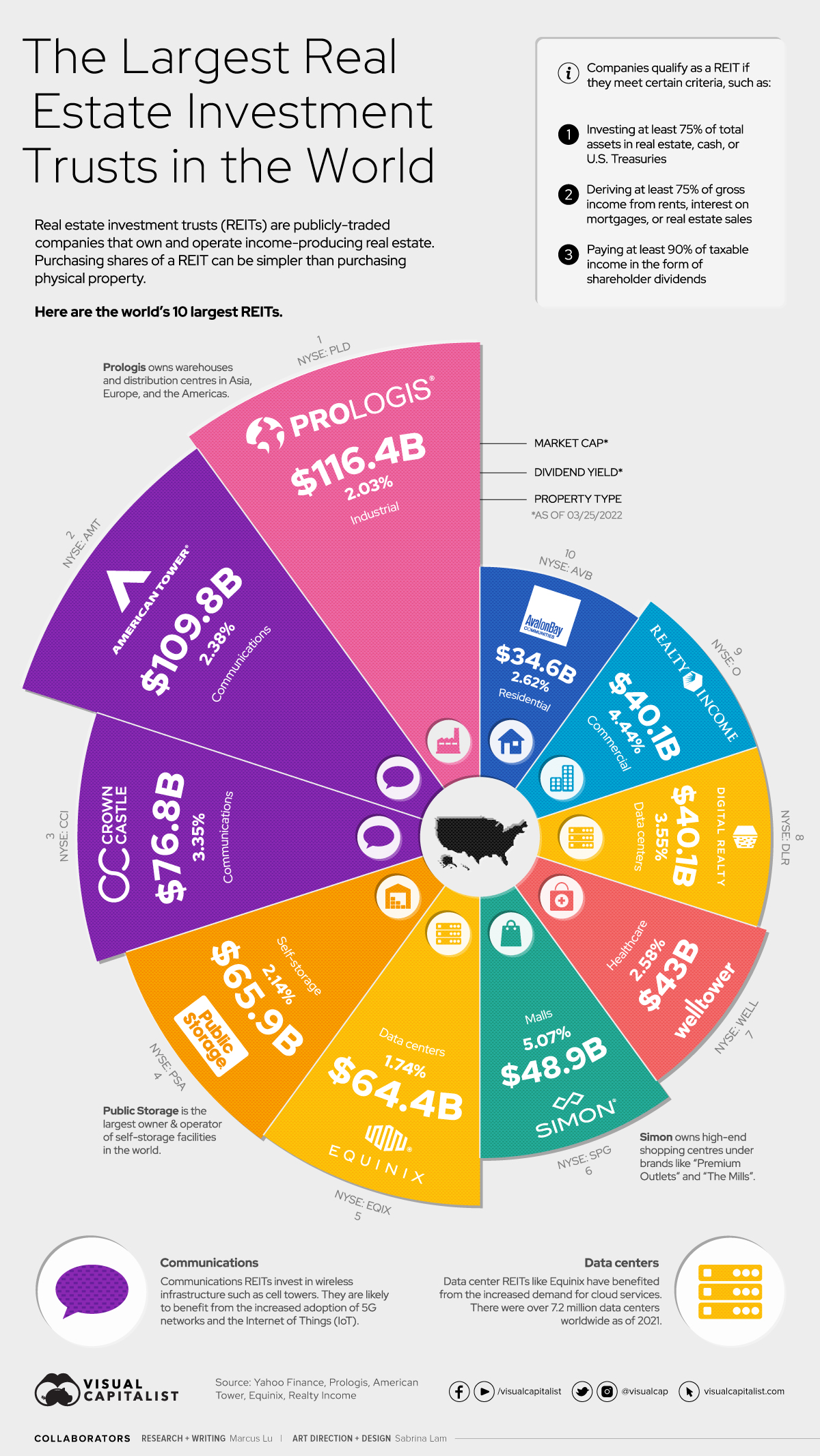

The Securities and Exchange Commission (SEC) has unveiled proposed amendments to the regulations governing real estate investment trusts (REITs) intended to expand the types of assets eligible for inclusion in REIT portfolios. The proposal, currently open for public feedback, seeks to encourage greater capital market participation and promote sector growth.

Under the draft revisions, REITs would be allowed to hold income-producing properties either directly or indirectly via wholly owned special purpose vehicles (SPVs). Eligible properties would now encompass a wider array of assets with stable and recurring cash flows, including shopping malls, warehouses, and infrastructure sectors such as transportation, energy, and information and communications technology (ICT).

This broader asset classification is anticipated to enable firms outside the conventional real estate development space to access the REIT market.

Francis Lim, chairperson of the SEC, emphasized the significance of the reforms, stating, "The proposed reforms will help ensure that the REIT framework remains robust and responsive to evolving market needs, thereby enabling the real estate sector to unlock more capital that will further support their growth and to contribute more to the development of our economy."

Additionally, the amendments propose extending the reinvestment period for listing proceeds from one year to two years. They also allow REITs to temporarily fall below the minimum public ownership threshold, contingent upon regulatory approval and appropriate public disclosure.

These proposed changes aim to modernize REIT regulations, providing the sector with greater flexibility to adapt to dynamic market conditions while fostering enhanced capital mobilization.

Recommended For You

Philippine Peso Expected to Stabilize Around 58 Despite Recent Volatility

Feb 10, 2026

Juancho Mabini

DSWD Urges Public to Support Indigenous Peoples and Street Families Through Organized Programs, Not Alms

Feb 10, 2026

Juancho Mabini

Southeast Asian Maritime Leaders Forge Stronger Alliance Against Human Trafficking and Regional Threats

Feb 10, 2026

Teofilo Abad

Americares Philippines to Continue Mental Health Support for Cebu Earthquake Survivors

Feb 10, 2026

Teofilo Abad